Reuters | | Posted by Ritu Maria Johny

India’s Adani Group is in talks to prepay all loans backed by pledged shares, a spokesperson told Reuters on Monday, while denying media reports that said the conglomerate was planning to cut back its capital spending.

Adani Group plans to trim its capital spending while providing more collateral in the form of stock pledges to lenders, Indian newspaper Mint said, citing people close to the development.

“False report, on the contrary Adani Group is moving to prepay all LAS (Loans Against Shares) finance,” a spokesperson for the group said in an emailed statement to Reuters.

Additionally, Adani Group’s domestic lenders do not plan to cut off the conglomerate from utilising sanctioned but unused credit lines for fears it could backfire and lead to defaults, Mint said in a separate report, citing bankers.

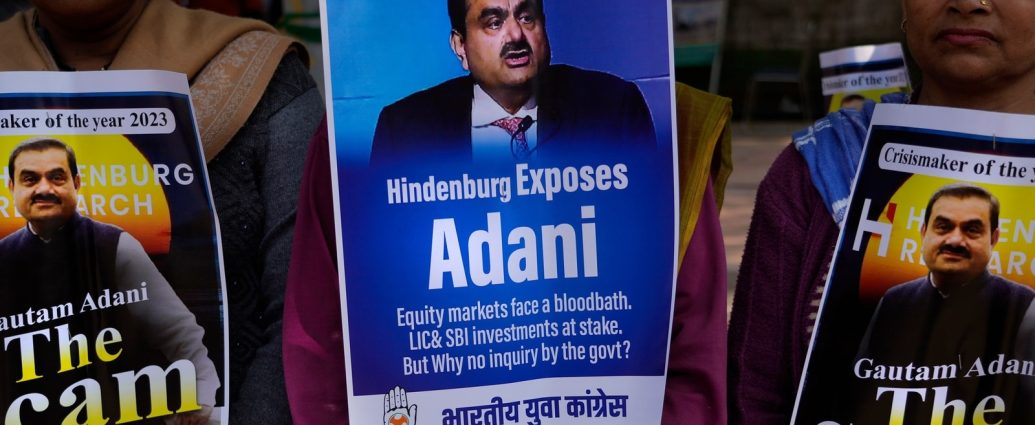

Shares of Adani Group companies have lost more than half their market value, topping a cumulative $100 billion, after U.S. short-seller Hindenburg Research last month raised questions about the group’s debt levels and use of tax havens.

In the brutal fallout of Hindenburg’s report, investors dumped Adani shares, while the group’s flagship company, Adani Enterprises, was forced to abandon a $2.5 billion share sale last week. Meanwhile, Group Chairman Gautam Adani lost his title as Asia’s richest person and slipped down the global rankings of the wealthy.