India’s central bank reiterated its resolve to fight inflation, while slowing the pace of increase in borrowing costs in a signal it’s nearing the peak rate.

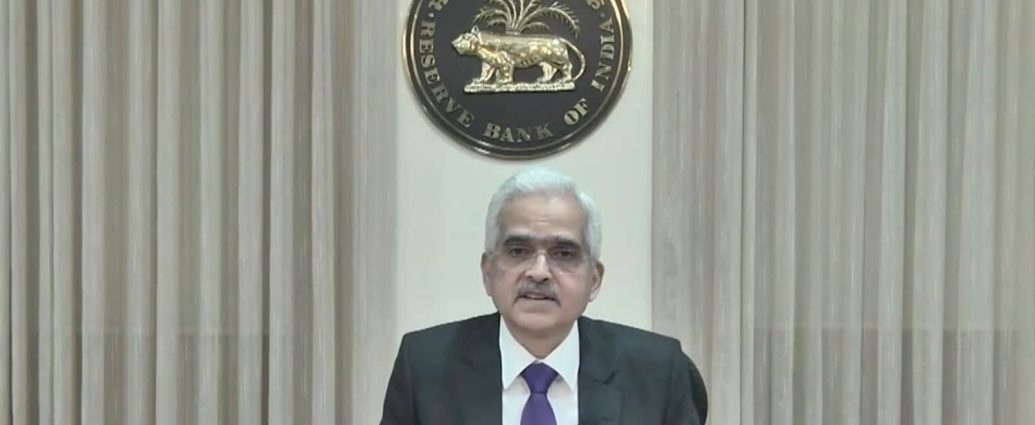

The Reserve Bank of India’s six-member Monetary Policy Committee voted 5-1 to raise the benchmark repurchase rate by 35 basis points to 6.25%, as predicted by 32 of 39 economists surveyed by Bloomberg. The rate panel decided to stay focused on withdrawal of accommodation, Governor Shaktikanta Das said.

Economic “growth in India remains resilient and inflation is expected to moderate,” Das said, announcing the decision through a webcast. “But the battle against inflation is not over.”

Stocks rose 0.1%, while the rupee advanced 0.1% to 82.5663. Bond yields jumped four basis points to 7.29% after the decision, which Das asked market watchers to decide whether it was hawkish or dovish.

The move comes as consumer prices have stayed above the central bank’s 2%-6% target for more than three straight quarters. Although inflation eased below the 7% level for the first time in three months in October, it’s hardly any comfort for a central bank, whose primary mandate is to ensure price stability.

CLICK HERE: RBI monetary policy review LIVE

The RBI last month wrote a letter to the government, explaining how global factors contributed to its failure. In the same note, it outlined a roadmap to bring price gains within target.

The central bank retained its 6.7% inflation forecast for the current fiscal year ending March, while lowering the growth expectation to 6.8% from 7% seen previously.

“I would like to state that growth continues to maintain resilience,” he said, citing that the latest growth forecast is evidence of a “very strong” growth impulse. “The focus on inflation fight continues. There will be no let up in that.”

“RBI’s decision was along market lines,” said Rahul Bajoria, an economist at Barclays Plc. “The step down in magnitude of hikes signals greater comfort with inflation outlook, but not enough to shift gears to neutral.”