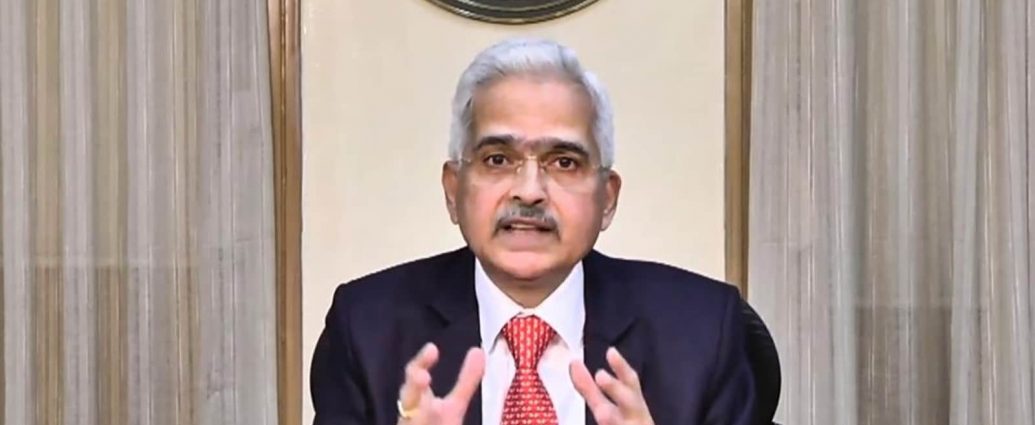

Reserve Bank of India governor Shaktikanta Das on Wednesday hailed the trial launch of central bank digital currency, calling it a landmark achievement.

“Yesterday, we launched the trial of Central Bank Digital Currency (CBDC) project… It’ll be a landmark achievement as far as the functioning of the entire economy is concerned. Reserve Bank is among the very few central banks in the world which have taken this initiative”, the governor was quoted as saying by ANI.

“We’ll try & launch CBDC in a full-fledged manner in the near future. The retail part of the CBDC trial will be launched later this month. CBDC will be launched in a full-scale manner because this is something where we have to proceed very carefully”, he added.

ALSO READ: Will digital currency pave way for paperless money in India?

On Tuesday, India’s central bank launched the trial version of the central bank digital currency.

“The use case for this pilot is settlement of secondary market transactions in government securities. Use of e-Rupee is expected to make the inter-bank market more efficient. Settlement in central bank money would reduce transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk. Going forward, other wholesale transactions, and cross-border payments will be the focus of future pilots, based on the learnings from this pilot”, RBI had said in a statement on Tuesday.

“Nine banks — State Bank of India (SBI), Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC — have been identified for participation in the pilot project”, RBI had stated.

During her 2022 budget speech in Parliament, Union finance minister Nirmala Sitharaman had announced that digital currency will be a reality and will be issued by the RBI using the blockchain technology. She had said that it will give a boost to India’s economy.